ITR Filing in Chandrapur | Income Tax Filing in Chandrapur

ITR Return in Chandrapur now become very easy for indian resident. People of Chandrapur can e-Filing their itr return online with minimum documents. Citizen of Chandrapur not need to go anywhere physically to file their tax return in Chandrapur. TaxWala is a platform which offer online ITR Filling to people of Chandrapur. ITR filing is made very simple at Taxwala in Chandrapur. File your Income tax return form in Chandrapur and get your Income Tax Return Filing Online in Chandrapur with right documents ✓ Form 16 ✓ TDS certificate ✓ PAN number. We are expert of ITR eFiling Service in Chandrapur and Income Tax Return Filing Online.

How to File Income Tax Return in Chandrapur ?

Get Expert Advice

Checking...

Retry »

Sending message...

Book Service Now

Fill in the form below and we will be in touch soon

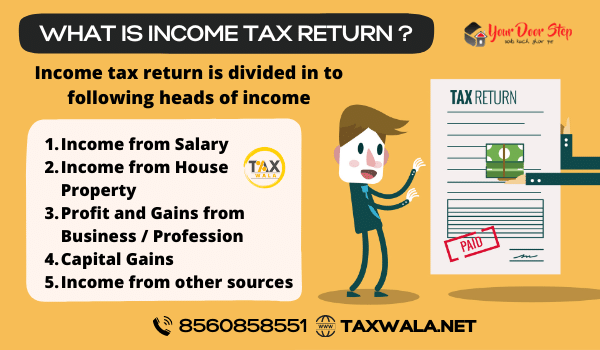

In simple words, Income Tax Return is just a form that is supposed to be filled and submitted to the Income Tax Department of India. It contains all the information regarding the person’s income and all the taxes that he or she needs to pay during the year. Information that is filled in ITR should belong to 1 financial year only, i.e. 1 April to 31 March of next year.

There are 7 different types of ITR forms, ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6, ITR 7, and the form to be filled is decided on the income and type of taxpayers.

Types of Income Sources

- Salary, bonus, commission, or remuneration

- House Property (Rent Income)

- Capital Gains

- Gain or Profit from Business / Profession

- Other sources like Interest, Dividend, etc

- Partner Remuneration

- Firm Net Profit

- Foreign Income

- Income by way of winnings from lotteries, crossword puzzles, races including horse races, card games, gambling or betting of any form or nature whatsoever.

- Rental income from letting of plant, machinery, or furniture with buildings.

- Pension or Family Pension.

Who Should fill ITR or Income Tax Return?

- Gross annual income is more than the basic exemption limit i.e. Rs. 2,50,000

- If the person has multiple sources of income such as house property, capital gains, etc.

- To request a refund of income tax.

- Someone who has invested in Foreign assets or has earned from it.

- Person who wants to apply for a loan or visa.

- If person is holding / member of a Firm, Company, LLP or Trust irrespective of profit or loss.

Documents Required for Filing Income Tax Return or ITR in Chandrapur

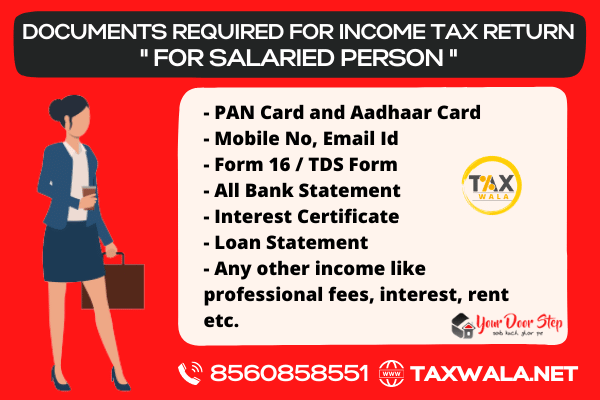

For Salaried Person

1. Pan Card and Aadhaar card

2. Form 16 and TDS Certificate (26AS Form)

3. All Bank Statement / Interest Certificate / Loan Statement

4. Any other income like professional fees, interest, rent etc.

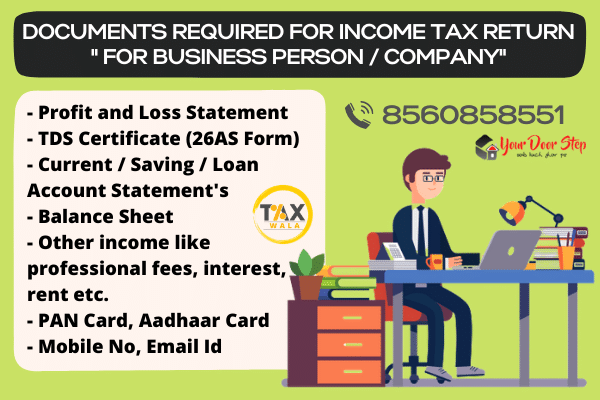

For Private Limited Company

1. Investment proofs

2. Company Pan Card

3. Balance Sheet

4. Profit and Loss statement

5. All Bank Statement / Interest Certificate / Loan Statement

6. Directors Pan and Aadhaar card

For LLP Company

1. LLP pan, address details, date of registration proofs

2. Balance sheet

3. Profit and loss statement

4. Partner Pan Card and Aadhaar Card

5. All Bank Statement / Interest Certificate / Loan Statement

Types of Income Tax Return Forms (ITR form)

| ITR | Description |

| ITR 1 (SAHAJ) | For individuals being a resident (other than not ordinarily resident) having total income upto Rs.50 lakh, having Income from Salaries, one house property, other sources (Interest etc.), and agricultural income upto Rs.5 thousand |

| ITR 2 | For Individuals and HUFs not having income from profits and gains of business or profession |

| ITR 3 | For individuals and HUFs having income from profits and gains of business or profession |

| ITR 4 | For Individuals, HUFs and Firms (other than LLP) being a resident having total income upto Rs.50 lakh and having income from business and profession which is computed under sections 44AD, 44ADA or 44AE |

| ITR 5 | For persons other than- (i) individual, (ii) HUF, (iii) company and (iv) person filing Form ITR-7 |

| ITR 6 | For Companies other than companies claiming exemption under section 11 |

| ITR 7 | For persons including companies required to furnish return under sections 139(4A) or 139(4B) or 139(4C) or 139(4D) only |

What is Income Tax?

There are two kinds of taxation in India: direct taxation and indirect taxation.

Direct Tax

Direct tax is a tax calculated and paid directly on your income, i.e. salary tax, etc. Income tax is a direct tax.

Indirect Tax

The Tax you pay while purchasing goods or services is called Indirect Tax. The seller of the product or service charges the tax and submits the same to the government. Such types of taxes are now covered under GST (Goods and Services Tax).

So basically, Income Tax is applied to any type of earning, For example- you have to pay income tax on your salary, tax on profit from mutual funds, tax on property, etc.

Why should I file Income Tax Return?

1. Sign of being a Responsible Citizen

The government advises that if your annual pay is above the pre-defined limit, you must file Income Tax Return and if you don’t do so, you might be penalized by the Income Tax Department. You can even file ITR voluntarily if you have annual income below the pre-defined limit.

2. If you want Loan or Credit Card, you need to file Income Tax Return

If you are planning to take Home Loan or apply for Credit Card in the future, it is beneficial for you to keep file Income Tax Returns every year and maintain a record of them. This is because the bank will need your ITR in order to approve your loan or credit card. Even financial institutions check your ITR before transacting with you.

3. To claim any adjustment against past loss, you need to file Income Tax Return

If any loss is incurred by a business or an individual, it can’t be shown for exemption for the subsequent years if you haven’t filed Income Tax Return. Such losses might be due to short-term or long-term investments or many other reasons. Hence, it is a good idea to keep filing ITR every hears because you can never be too sure for the future.

What if I don’t file Income Tax Return?

If you don’t file ITR, you will receive a notice from the Income Tax Department asking you to file your return. You might get a penalty as well in case you don’t file ITR on time and you might also be not given your return as well. Also, if it is found that you owe tax to the government, it is advised to pay the tax at the earliest otherwise the interest keeps adding up.

A new section 234F has been inserted in Income Tax Act, 1961 with effect from Assessment Year 2018-19 (Financial Year 2017-18). According to it, a penalty can be levied if you don’t file return on time. The penalty is now paid before TR is filed however earlier, the penalty was levied discretion of the Assessing Officer.

What is Form 16?

If your employer deduct TDS, that a Form 16 or TDS Certificate is issued to you. TDS stand for Tax Deducted at Source. As the name suggests, it is the tax that is deducted by the employer before paying salary to you. All of this tax is deposited to the government and it is also deducted from the salary on behalf of the government. Once the tax is submitted, the employer is required to provide you a certificate that consists of all the details of the deducted tax. This certificate is called Form 16.

If no tax is deducted by the employer then no Form 16 is issued to the employee. Form 16 from your employer is required to file an Income tax return. You can directly upload your Form 16 and file your income tax return quickly.

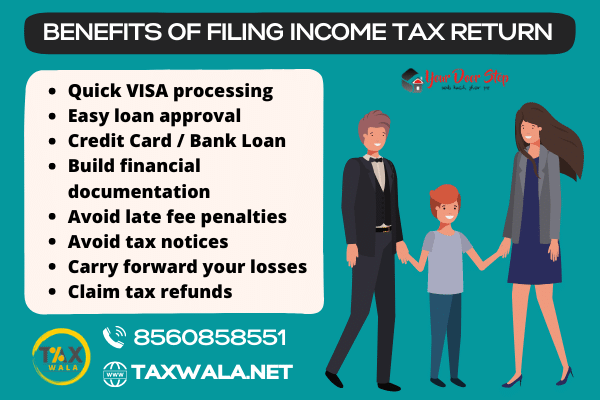

Advantages of filing Income Tax Returns in Chandrapur

- Avoid late fees under 234F i.e upto Rs. 10,000

- Avoid Tax Notices.

- For claiming of Tax Refund.

- Carry forward your losses to next financial year i.e house property and depreciation.

- it will help you in loan processing, business loan, home loan etc.

- You will easily get credit card.

- You will easily get study loan and foreign VISA.

- For Income Proof and Address Proof.

Why Choose TaxWala for Help with Filing Income Tax Return

Here are some of the reasons to choose us for Filing Income Tax Return in India

- Help you to choosing correct ITR Form.

- We put proper report all sources of income.

- Putting of correct personal information.

- Our expert team filling of return after reconciliation of Form 16 and TDS Certificate 26AS.

- More than 5 lakh users use our system to file their income tax returns with accuracy.

- We value your data and respect the highest data security standards to keep them safe.

- The company is managed by professional and experienced people whose goal is to help users with the best tax filing experience.

Simple and Easy Service Booking Process

Need a service? All you have to do is either fill the form available on each service page or directly contact us on the given contact numbers and simply name the service you require. after a few basic questions, our team will assign a professional to carry out the demanded service.

Fast Service

Compared to other service providers in the market, our service is much faster and reliable. We are not the ones saying that these are the words of our permanent customers.

Affordable Price

We have structured our services in such a way that we are able to provide them to our customers at very attractive prices.

Quick Response and Resolution

As soon as we receive the information about the problem we immediately assign a professional to visit your location or consult with client. Also, dedicated team are trained so they can immediately recognize the issue and provide the solution for the same.

Process to avail Income Tax Return Service in Chandrapur

We make all our services simple and easy to use by keeping our customers in mind. This helps us achieve a high customer satisfaction rate. Follow these steps given below –

1. Contact us on the given numbers or fill the contact form given above.

2. Tell us the are you want to file Income Tax Return.

3. Mention your name, and phone number to make it easy to connect.

Income Tax Return FAQs

To file your Income Tax Return you can connect with our team at Taxwala.net. Our team will help you out in everything from explaining the process to documents need. So you can stay tension free.

Above we have mentioned about who can file Income Tax Return in India. If you belongs to any of the above mentioned conditions, you have to file ITR in India. Otherwise, you might receive penalty from Income Tax Department

You can pay tax directly by going to the Income Tax Department Website and pay using netbanking and challan 280.

if you don’t have Form 16, you can still file ITR by using your pay slips.

When an employer deducts tax on your salary, he or she pays that tax to the Government and provides you a certificate which includes all the details of about the tax. This certificate is called Form 16.

You can connect with our support team by mailing us at info@taxwala.net

A ‘Chartered Accountant’ (CA) is a person who is a member of the Institute of Chartered Accountants of India (ICAI) constituted under the Chartered Accountants Act, 1949 (38 of 1949).

ITR-1 can be filed by a Resident Individual whose:

o Total income does not exceed ₹ 50 lakh during the FY

o Income is from salary, one house property, agricultural income (up to ₹5000/-).

o Interest from Savings Accounts

o Interest from Deposits (Bank / Post Office / Cooperative Society)

o Interest from Income Tax Refund

o Interest received on Enhanced Compensation

o Any other Interest Income

o Family Pension

Yes, any excess tax paid by you can be claimed as refund by filing your Income Tax Return. After your return is processed, ITD checks and accordingly accepts your refund claim, and then the amount is credited to your bank account. You will also get a message on your email ID registered on the e-Filing portal.

No, you can only file Income Tax Return for one AY in the current financial year. Tax filing beyond the last one year is only possible when you receive a notice from the Income Tax Department.

Yes, you can re-submit return in case you have already filed your Income Tax Return and later discover that you have made a mistake. This is called a Revised Return. Your return has to be revised three months before the end of the relevant AY. For AY 2021-22, the due date for filing revised return is 31st December 2021.

ITR-2 can be filed by individuals or HUFs who:

· Are not eligible to file ITR-1 (Sahaj)

· Do not have income from profit and gains of business or profession and also do not have income from profits and gains of business or profession in the nature of:

o interest

o salary

o bonus

o commission or remuneration, by whatever name called, due to, or received by him from a partnership firm

· Have the income of another person like spouse, minor child, etc., to be clubbed with their income – if income to be clubbed falls in any of the above categories.

ITR-4 can be filed by a Resident Individual / HUF / Firm (other than LLP) who has:

· Income not exceeding ₹ 50 Lakh during the FY

· Income from Business and Profession which is computed on a presumptive basis u/s 44AD, 44ADA or 44AE

· Income from Salary / Pension, One House Property, Agricultural Income (up to ₹ 5000/-)

· Other sources which include (excluding winning from Lottery and Income from Race Horses):

o Interest from Savings Account

o Interest from Deposit (Bank / Post Office / Cooperative Society)

o Interest from Income Tax Refund

o Family Pension

o Interest received on enhanced compensation

o Any other Interest Income (e.g., Interest Income from unsecured loan)